A Short Guide to T304 T303 T316 Stainless Steel Alloys

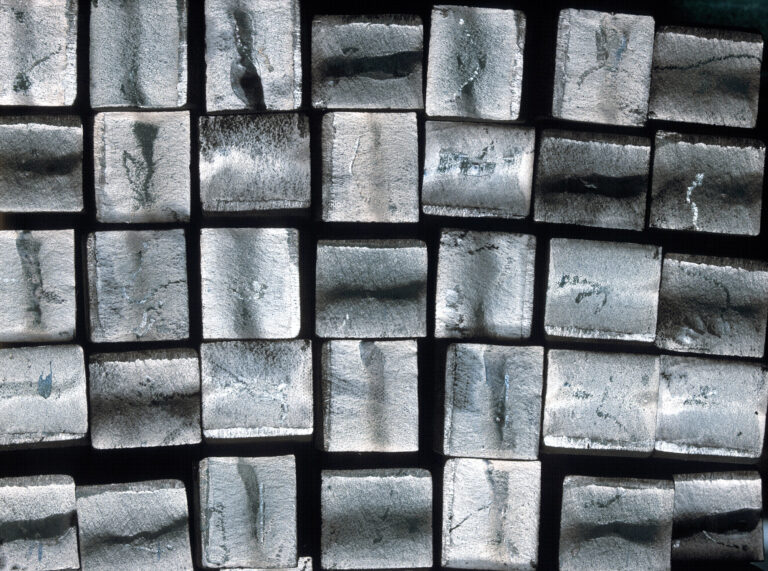

Stainless steel is used for everything from kitchen gadgets to ocean rigs. Yet, not all grades suit every job. Enter T304, T303, and T316 stainless steel alloys—your go-to options at Alcobra

As Q4 2025 unfolds, the global metals and steel industry is navigating a landscape of cautious growth amid persistent challenges. For U.S. steel suppliers, this means a pivotal moment to leverage domestic advantages like tariffs and sustainability mandates. According to the latest Atradius report, global basic metals output is set to expand by 2.2% this year before tapering to just 0.7% in 2026.

As a trusted U.S. steel supplier with a wide variety of other alloys and custom processing services, Alcobra is here to help fabricators and manufacturers adapt.

This post unpacks key trends, demand shifts, and supply hurdles—empowering steel suppliers to build resilient strategies. Whether you’re sourcing for automotive builds or aerospace components, partnering with reliable steel suppliers like Alcobra ensures quick access to U.S.-melted materials that meet Buy American requirements.

The global steel market’s challenging environment stems from oversupply—particularly from China—and economic headwinds, leading to marginal global expansion.

U.S. steel suppliers stand to gain from 25% tariffs on imports, which boost domestic market share, though softer demand in construction and automotive could slow gains.

Additionally, for global steel suppliers, the focus is on agility: High energy costs in Europe widen the U.S. competitive edge, but volatility demands diversified inventory. Domestic suppliers are stocking up, but can they keep pace with a growing domestic demand?

Core sectors like construction, manufacturing, and transportation continue to drive steel demand, with urbanization in Asia—especially India—pushing steady needs for infrastructure and energy projects.

In the U.S., expect large steel suppliers to prioritize customers in:

As a proactive steel supplier, Alcobra supports these industries in the Pacific Northwest and around the country, maintaining a focus on value-added options such as machining, laser cutting, water jetting, saw cutting, etc.

U.S. tariffs shield local steel suppliers but inflate costs for allied imports, like from Canada, where output contractions loom. Europe’s woes—high energy post-Ukraine and the Carbon Border Adjustment Mechanism (CBAM)—further highlight U.S. strengths in affordable production. In other parts of the world, oversupply from China is flooding markets, greatly lowering prices and margins while also sparking some insolvencies in Southeast Asia.

For steel suppliers, building resilient chains is crucial. Disruptions could delay projects, but domestic sourcing mitigates risks. Alcobra delivers tariff-free steel in days, helping to empower local markets and supporting a regional hedge against global flux. Domestic suppliers are leveraging a competitive edge for local customers and we are proud to be a part of that effort.

These shifts position U.S. steel suppliers as stability anchors in a turbulent market.

At Alcobra, we’re committed to fueling your success with custom steel solutions. Explore our carbon steel inventory or get a quote today—let’s shape a stronger supply chain together. Contact us today

Stainless steel is used for everything from kitchen gadgets to ocean rigs. Yet, not all grades suit every job. Enter T304, T303, and T316 stainless steel alloys—your go-to options at Alcobra

As Q4 2025 unfolds, the global metals and steel industry is navigating a landscape of cautious growth amid persistent challenges. For U.S. steel suppliers, this means a pivotal moment to